RETHINKING MBAS

By Shola Adenekan

Friday, May 1, 2009.

Spyros Pyrgiotis is one of the youngest people ever to be offered a place on an MBA course in Britain.

But with no job and multiple loan refusals, the budding entrepreneur and his girlfriend have turned to the internet to fund his quest for an MBA degree.

While Spyros Pyrgiotis has launched the website thetextpage.com to link to advertisers, his girlfriend Liana Stewart has also started a Facebook support group.

“I’m hoping that the MBA will equip me for my business ventures and provide me with a vast amount of business understanding,” says the 23 year-old former sound engineer and radio presenter.

“I’m looking to combine the knowledge I will gain with my previous education and work experience.”

Mr Pyrgiotis and his girlfriend are not the only couple thinking outside the box by turning to the internet to create awareness for their MBA dilemma.

On the other side of the Atlantic in America, Robin Stearns has also started a website to help her unemployed husband Michael secure a job.

On myhusbandneedsajob.com, Mrs Stearns can be seen holding up a sign that says “Hire my Husband.”

Mr Stearns’ resume is strong; he has work experience in the financial industry and has recently received an MBA degree from the prestigious Georgetown University.

He has tried everything from networking to placing ads in newspapers, but he still cannot find a job in corporate marketing.

Some of the emails Mr Stearns have received so far mocked him for subjecting himself to public ridicule.

‘Hasty solutions’

Desperate times, desperate measures: As the tumult in the financial markets continues, current and prospective MBA students are finding it difficult to secure bank loans or find openings in the job market.

And with the world economy in panic and many multinationals on both sides of the Atlantic struggling, a lot of people are also wondering what role business schools played in the biggest global crisis in nearly eight decades.

For many years, studies show that almost half of MBAs have chosen jobs in the financial sector, with the largest proportion going into investment banking.

And critics of business education blame the crisis on business schools for running programmes short on ethics.

They point out that students are trained to devise hasty solutions to complicated financial problems.

Others say business schools have become too removed from the real world, and instead have been producing students who are too focused on protecting shareholders’ interest to the detriment of social considerations.

Sharon D Oster, Dean of Yale School of Management in Connecticut, USA, admits business schools failed to see the full picture in terms of what has gone on in the past six months or so.

The fact that the housing bubble was likely to burst was of course known by some; one of her colleagues Robert Shiller was one of the early people to predict this.

And many people also well understood that a fall in house prices would have an economic impact on consumption by households and therefore potentially cause an economic slowdown.

“The piece that most people – in economic departments and finance departments across business schools, but also in banks, regulatory entities and governments – all failed to see, was the way in which financial institutions essentially fell apart,” Prof Oster says.

“Seventy five years of financial stability lulled everyone.

“In retrospect, more attention to risk management and the way in which all the pieces fit together would have been helpful.”

Theory and practice

It is a sentiment shared by Carolyn Y. Woo, Dean of Notre Dame Mendoza College of Business in Indiana, USA.

“I believe that our current crisis is caused by a failure of values fuelled by perverse incentives, which trumped sound judgment and overwhelmed regulatory enforcements,” she says.

While agreeing this is a time for self-reflection by business educators, Prof Woo, like many heads of MBA programmes in Britain and America, believe that the association between business education and the crisis is dangerously over-generalized.

“Many responsible parties do not have MBAs,” she says. “Conversely, many MBAs populate highly successful and complex companies which create both economic and social value. “

“Having noted the above, this is definitely an opportunity for business schools to do more to make ethical thinking part of the fabric of their curriculum.”

Employers and recruiters agree that the MBA remains a highly regarded qualification and can certainly open up career opportunities for professionals, however, they say that they are now looking for more than just a qualification.

Phil Sheridan, UK Managing Director of Robert Half, a leading recruitment company for the financial sector, says: “Clearly, the technical aspects of finance are important, but for our clients, their focus is on bringing in great performers who can hit the ground running, and really show how they can deliver measurable value like identifying tangible savings or streamlining processes to cut costs.”

“In this market, it’s about the pound, shilling and pence savings you deliver, not theory.”

For many top universities in Europe and America, business education is the goose that keeps on laying golden eggs.

Recovery

Admission tutors in many top business schools confirm they are already witnessing a surge in applications, as diminished job prospects force many to get new skills. In addition, MBA programmes are less expensive to run than other postgraduate courses that demand state-of-the-art laboratories.

These students are also more likely to be matured, wealthier and make less demand on university resources.

Tuition fees for a course in Britain can be as much as £64,000, and business schools’ alumni tend to be big donors to their alma mater.

In recent years, critics have been warning of an endemic culture of cheating among MBA students, which they attributed to a growing list of corporate ethics scandals.

A 2006 study of cheating among US graduates, published in the journal Academy of Management Learning & Education, found that 56% of all MBA students cheated regularly – more than in any other discipline.

The study also suggested that business students are also more likely to find out about a test from a fellow student who had taken it.

Both Yale and Notre Dame business schools say they initiated change long before the current crisis unfolded, by incorporating ethics in the core as well as driving ethics discussion across the curricula.

In Britain, the Association of Business Schools, which represents more than 100 institutions in the UK, says in 2004, it became a partner in the UK Government’s Corporate Social Responsibility Academy.

This, the organisation points out, further embedded social, environmental and ethical considerations into the delivery of courses among its members.

Business educators agree it is important that ethics are not an appendage in the margin but are built into the curricula.

And students, they say, need to be “dyed-in-the-wool ethicists.”

Chris McKenna, director of MBA at Oxford University’s Said Business School, says the curriculum is now being reviewed.

“We are collecting records from failed institutions and holding public discussions, and talking to executives about this failure.

“We want to help people understand what happened in and outside the classroom.”

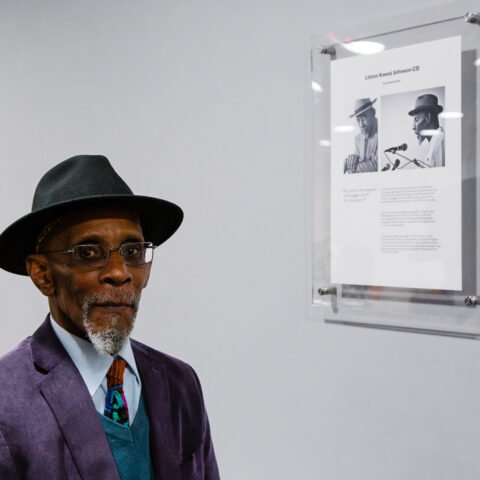

Shola Adenekan is the editor of The New Black Magazine. This article originally appeared on the BBC News website.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Unlock your path to success with the MuleSoft Integration Associate Exam! Boost your career by mastering essential integration skills. Our comprehensive study guide and resources ensure you’re fully prepared to ace the exam and gain the certification that sets you apart in today’s competitive tech landscape. Start your journey to success with MuleSoft today!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/cs/join?ref=S5H7X3LP

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/register?ref=IXBIAFVY

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/register?ref=IHJUI7TF

This post is worth everyone’s attention. Where can I find out more?