How to make it through the mortgage maze

It’s good to know that the housing market in the UK is now regulated. But with advisers lining up to offer bewildering array of tempting deals, whose recommendations should you trust?

Homebuyers in the UK borrow around £25 billion a month in mortgages. But given that we do so much borrowing, we’re hardly experts at it. A recent Moneywise survey revealed that the average homeowner was paying a rate of 5.14% – 1.14% more than the best buys of the time.

To give us our due, shopping around for the right mortgage isn’t easy. David Hollingworth, head of communications at broker London & Country Mortgages says: “At any one time there are likely to be around 4,000 different loans available.”

A quick search on the internet will bring up hundreds of deals, each with different features, set-up costs, penalties and freebies – like free legal advice or cashback.

As of recent, life was supposed to get easier because mortgages began to be regulated by the Financial Services Authority. One of the big changes the regulator has brought in is a key features illustration which lenders have to provide before you apply for their mortgage.

But even when you’re armed with this information, problems remain. How, for example, do you weigh up the advantages of a lower fixed rate against the disadvantages of higher early-repayment penalties?

Ask the expertsThese headaches lead many of us into the arms of the experts who will hold your hand throughout the process. First off, they will give you a questionnaire (or fact-find) so they can understand your finances. They will then scour the market and make a recommendation.

Brokers should also be able to save you money because many will have access to exclusive deals that will beat lenders’ direct offerings.

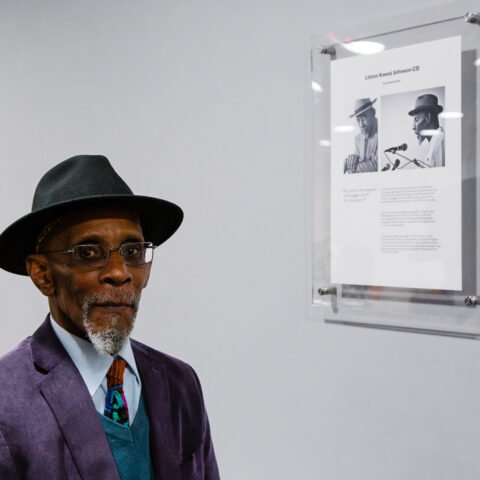

The barrage of mortgage information available can be overwhelming even for highly educated folks

The right choiceBut not all experts are equal. You can choose between a broker or an IFA. And a good broker will be just as much of an expert as a good IFA who deals regularly with mortgages, and better than an IFA who doesn’t do much mortgage business.

You then need to choose between an expert that charges fees or one that takes a commission from the lender (in which case you receive advice free of charge). Each has its advantages and disadvantages.

In a regulated environment, brokers paid by commission must justify their recommendation, so shouldn’t be able to get away with selling unsuitable products just because they pay a high commission.

Some brokers will give you recommendations from the entire marketplace while others offer access to a limited panel of lenders representative of the market, but you shouldn’t automatically dismiss brokers working from panels as many panels feature high-street lenders, specialist lenders and smaller building societies.

Now that mortgages are regulated, you should be confident that your mortgage broker will offer competent advice and a sound service. They will have had to pass a mortgage exam and will have had to prove to either the regulator, or the firm whose licence they are operating under, that they are up to the job. Nonetheless, there will always be a few brokers that don’t live up to your expectations.

The best way to find a good broker is through recommendation or by doing your own research. You can confirm that either the person or firm is regulated by the FSA through its website www.fsa.gov.uk or by calling 0845 606 1234.

The first meetingOnce you have chosen a broker or IFA and go along to the first meeting, you still don’t have to use them. They will provide a document known as an initial disclosure document. Pay close attention to the details. As well as the breakdown of fees, this will state the nature of the service you can receive.

All mortgage brokers should offer advice and a recommendation, if they don’t it may be because they are trying to avoid complaints.

If you feel uncomfortable with an IFA for any other reason, the message is: walk out and find another, better, adviser. If this moment of realisation comes too late in the day, the good news is that regulation has brought brokers under the remit of the independent arbitrator, the Financial Ombudsman Service (FOS).

As with any other financial grumble, you first take your complaint to the firm in question, and if it does not come back with a satisfactory response, the FOS will look at your case. You can contact the FOS at www.financial-ombudsman.org.uk or call 0845 080 1800.

For most people, regulation should mean that you carry on receiving a high standard of advice. However, when seeking advice from any professional, it pays to do your own research and question, question, question, just to make sure.

With thanks to Interactive Investors where this piece was originally posted

Please e-mail views to comments@thenewblackmagazine.com

Send to a friend |

View/Hide Comments (0) |

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/register?ref=IHJUI7TF

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.