LIVING WITHIN YOUR MEANS

Â

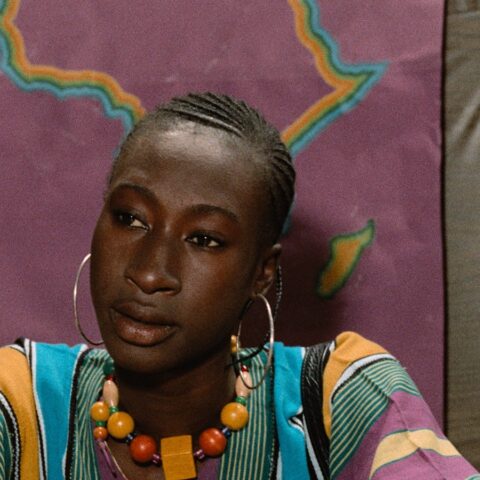

By Lawna Elayn Tapper

Â

Â

Monday, February 16, 2009.

Â

“I think there is a mood of austerity, a reaction against greed, excess, waste, tax-cheating and selfish, self-indulgent behaviour.” These words, from Vince Cable, Treasury Spokesman for the Liberal Democrats, reflect Britain’s awakening to the fact that we’ve been sick! For the last 20 years a pandemic of ‘affluenza’ has engulfed the nation and been so widespread, few even recognized it as an illness; they thought it was the norm!

Â

So virulent was this fever, it made us all delirious: the youngest adults only knowing the word recession from history books, and older generations so caught up in this malaise, they forgot two things: that a recession could happen again, and what it meant to live within your means.

Â

So what is it to live within your means? It begins as a mathematical concept – you look at how much money you have coming in before you decide how much you can spend. Then you look at your priorities – which means thinking about your ‘spending needs’ before your ‘spending wants.’

Â

In modern times, however, doing this became more difficult as borrowing became easier to obtain – credit cards and store cards seemed to increase disposable incomes per household, massively. And, ironically, only those ‘non-persons’ who had no credit found it hard to get credit – it was the ones with the mortgages that could get the car and business loans! People felt they had real power to live outside of their means, and they weren’t just pretending; with all their credit, people did actually think they had more than they had.

Â

It may seem hard for younger people to believe, but there was a time when to live within your means was less of a struggle. In the days when people were more aware of Britain’s social strata, they knew more clearly where they were stationed; if you were working class, in general, you happily settled for the basics.

Â

Then came Prime Minister Thatcher who started rolling back these boundaries. With the extension of home ownership, the competitiveness of privatization, the rise of yuppies and buppies, and accessibility of degree courses, Britain began to look less class-based and more meritocratic from the outside. Even when the recession of the early 90s came, the sadness it brought for people who had lost their homes, business’ and jobs seemed short-lived as it transformed into opportunities: house prices began to soar and people began to understand the true meaning of a seller’s market.

Â

Despite being from the opposition party, Prime Minister Blair built on Thatcher’s ambitions – anyone could have been forgiven for thinking Britain was a one-party state, instead of one governed by two main parties, one with capitalist ideals and another with supposedly socialist ideals.

Â

As we near the end of the first decade in the new millennium, Gordon Brown has taken over from Blair, and at first he thought it was all good: poor people living like rich people; diverse groups going to university – maybe not at 18, with the whole gap year fascination, but at some point, lots more ‘ordinary’ parents managing to school their children in the private sector; everyone having Nintendo DSs and PSPs and Wiis; plasma TVs; flashy cars; annual holidays; their own home – or two; home computers; demanding children – they’ve all got the lot. What is the difference between the wealthy and the poor, actually?

Â

One wonders if it’s any more than a matter of a difference in accent, social circles, post codes, net incomes or, of course the main fact: the poor acquires, but struggles to do so, while the wealthy acquires with ease, and on a superficial level; who’s going to know who’s who? Deep down we all know what’s considered the best of any given period in time, and we all want the best. Poor people have had their eye on, and been ready to emulate, the rich for years, but they have never done so good a job as they have in the last few years.

Â

And this is what is known as the age of consumerism – and it never did promote the idea of living within your means. Sources say the debt now burdening the British public is £1.44 trillion and that a third of all consumer debt in Europe belongs to us. Whoa! Most of us don’t even know how to count to a trillion! Consumerism brought with it a mindset that killed the consciousness of the nation, particularly that of ordinary folk.

Â

For years, consumers have been bombarded with advertisements and viewed as purses, not human customers, or part of an interdependent relationship whose value is just as important as their money.

Â

The producers in the human world are not as generous as those to which we refer when speaking ecologically: unlike plants, which are nature’s producers and use sunlight to make their own food, our producers prey, ravage and kill. They forget that consumers deserve the utmost respect for having chosen to spend their hard earned cash with a particular purveyor. Instead, consumers are lashed with images which mislead us and twist our sense of self-value so that we buy according to our wants and not our needs – cars don’t just get us from a-z, they make us sexier, happier, more youthful and more important than someone else.

Â

Producers treat people like commodities, referring to them as marketable, sometimes buying and selling them on the basis of their looks and physiques: let’s remember Michael Jackson and the mess that vanity has made of him! Producers feed our egos – that vain, self-obsessed and shallow side of ourselves – and trick us into thinking that we are our egos so we want things and forget about the fact that we don’t need them.

Â

Often we don’t even want them, but the fact that we have them will impress someone else, so suddenly, we need them! Producers create associations with certain lifestyles so people who don’t even love the ocean want to own a yacht because they’ve been presented with it as a symbol of wealth. Ultimately, people lose track of their real tastes and go for the things that people give credit for, and not the things they actually like.

Â

So how do we redress this balance? As business quietens for the most exclusive and expensive stores, those furnishing more necessary needs like the supermarkets, promote the essential value of their products and boost their no-frills ranges. Publications feature articles on how to recycle old clothes and reuse food. Blogs on the internet share money-saving strategies and ways in which families can become more self-sufficient – for instance, growing your own vegetable gardens. It was Benjamin Franklin who said, ‘pay what you owe and you’ll know what you own.’ We need to blog that in – it seems he knew what he was talking about!

Â

But is it just as simple as cutting back on luxuries? At some point we’ll need to tackle the psyche that creates a mess like this so we’re not so easily fooled – sounds like another job for parents, schools and certainly for the media: children (and the public in general) need to be taught how the financial world works – it’s no wonder we grow up so financially illiterate; we learn virtually nothing about this. Living within your means does begin as simple mathematics, but we’re now at the point where trying to achieve this has become a psychological battle.

Â

So after this episode, we must make sure we’re wiser; as we teach our children about money we must ensure this is not done in an academic context, but a real life context that includes real discussions – let them talk about real options – job or benefits, buying fresh food or junk food, home ownership or renting, employment or self-employment, spending now or saving for the future, or striking a balance between the two, what it means to be a consumer and what it should mean. Does our education system want to make its future wise or not – answer me parliamentarians! Wake up nation!

Â

Now it’s got really bad and people are waking up out of their comas. The London Times columnist India Knight wrote, ‘I am happy to observe that decades of vulgar excess are finally over… unwelcome as it may be there is a possibility that it will result in us straightening out our priorities.’ Yes, every crisis brings with it a new opportunity to ‘get it right.’ But this requires honesty and courage; can we now look capitalism in the eye and question its relationship with consumerism and materialism and ask ourselves what legacy we are leaving future generations?

Â

I found a stray excerpt from an article obviously on this subject: ‘You want to live within your means? Stop believing in the superficial trappings outside of yourself and recognize that there is nothing you can possibly buy that will make you a better person. Spend your money only on what you need. Spend yourself on who you want to be.’ There. I couldn’t have said it better myself!

Â

Lawna Elayn Tapper is with Rice’n’Peas Magazine where this piece first appeared. She can be reached at info@ricenpeas.com

Please email comments to comments@thenewblackmagazine.com

Very interesting details you have noted, thanks for posting.Expand blog

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.