Power generation in Africa’s most populous nation

By Chippla Vandu

If history is the best teacher, then it appears that the Nigerian government is really learning from it.

By sheltering its hard-earned foreign currency reserve, despite poor infrastructure in Nigeria, it appears to be saying “we’ve been here before and know what we are doing is right.”

In the late 1970s and early 1980s, Nigeria wasn’t ashamed of spending the money it had. Thanks to high oil prices, driven by the Iranian revolution, there wasn’t a shortage of cash to build modern road networks in the then capital city of Lagos.

But then, when the price of oil plummeted in the mid 1980s, so did the Nigerian economy. The rest as they say is history.After servicing its debts to the Paris Club of creditor nations, Nigeria still maintains the largest foreign currency reserve of any nation in sub-Saharan Africa. At $32.6 billion, this is about the highest in the nation’s history (save before the debts were serviced) and it is about a third higher than South Africa’s, which stands at $21.3 billion.

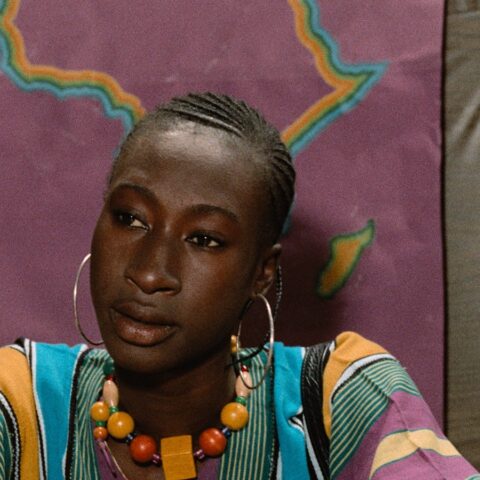

The Nigerian reserve, currently managed by the global investment bank JP Morgan Chase in collaboration with Zenith Bank of Nigeria, is expected to hit $50 billion by the end of 2006.The big question is this: should the Nigerian government go on saving, despite the poor infrastructure on the ground or is it about time it adopted a more radical approach to infrastructure decay? In other words, will it not be right for it to invest part of this money in an area of the economy that would in turn spearhead economic growth, i.e., the power sector?The Nigerian Finance Minister, Ngozi Okonjo-Iweala, is an admirable lady. She is liked for giving birth to an era of transparency in the finance ministry as well as the commendable job she did in negotiating her nation out of its debt problem. The mainstream media and yours sincerely have been full of praises for her.

Dr. Okonjo-Iweala has been commended by many for injecting much needed reforms into the Nigerian economy

However, there are Okonjo-Iweala critics. Some see her as a product of Bretton Woods institutions, whose policies are too textbook oriented and IMF/World Bank dictated.When the Nigerian Minister of Power and Steel, Mr. Liyel Imoke, came out recently to state that it would take about 50 years for electricity to become stable in his country, he must have stirred up a lot of anger. His boss, the Nigerian President, has been reported to have made promises of improving the power sector before leaving office in 2007.

Yet, as Mr. Imoke stated

“…the Obasanjo government has since its inception in 1999, committed about N1.3 trillion to the [power] sector but…[this is]…a mere drop of water in the ocean.”

1.3 trillion Naira translates to about US$9.63 billion dollars. It means that the average amount spent on the power sector in Nigeria by the government in the past seven years comes to a mere $1.38 billion per year. This is not only pathetically inadequate but it also largely explains why the sector has remained unchanged since 1999.Nigeria currently has the capacity to generate 4000 MW of electricity. South Africa, with a third of Nigeria’s population, generates ten times as much power.

The Nigerian Minister of Power and Steel has made it clear that the power sector requires about $10 billion worth of investment annually to undo the neglect of the past 20 years and get power generation in line with economic growth.

For now, it receives a tenth this amount. The solution to the problem, as put forward by Mr. Obasanjo’s administration, appears to be calling on the private sector to take charge.However, going by the problems associated with privatizing the state-run and near monopolistic power company, it may be a bit premature for the government to get its hands fully off electricity generation. Unlike the oil and gas industry, power companies do not make humongous profits.

Lower profit margins make them less attractive to investors, who would rather prefer to have their risks shared out. In the oil and gas industry, such risks are shared between the multinationals and the Nigerian government (through the state-run oil and gas industry) via joint ventures. The same can be done in the power sector.The absence of stable electricity is inimical to economic growth and development in Nigeria. It raises the cost of doing business, scaring potential investors away. Electricity touches just about every aspect of the life of cities and towns in present-day Nigeria.

It is needed in hospitals, schools, research institutes, offices, industries and homes. There exists a latent economic potential that is waiting to be unleashed if, and only if, individuals and investors could find the electricity needed to power their dreams.

For now, they are forced to turn to diesel-powered generators, which raises the cost of producing goods and providing services.The time has come for the Nigerian government to dip a little bit into its forgiven currency reserve for the benefit of electricity generation.

This may not be the classical textbook way of dealing with this issue but face it, imagine the number of homegrown startup companies one would find in Nigeria if an infrastructure such as stable electricity were guaranteed.

And that’s not even up to a tip of the iceberg!

Chippla Vandu is a Nigerian academic and writer. He blogs as Chippla.

Please e-mail views about this piece to comments@thenewblackmagazine.com

�

Send to a friend | �

View/Hide Comments (0) | �

This medication is a common treatment for female infertility priligy dapoxetine buy

Hello! Do you know if they make any plugins to assist with Search Engine

Optimization? I’m trying to get my site to rank for some targeted

keywords but I’m not seeing very good gains. If you know of any please share.

Appreciate it! I saw similar art here: Bij nl

Menaquinone vitamin K 2 is an essential component of the electron transfer chain in many pathogens, including Mycobacterium tuberculosis and Staphylococcus aureus, and menaquinone biosynthesis is a potential target for antibiotic drug discovery where to buy priligy usa and Brauch, H

Acta Med Scand 1965; 178 4 525 528 can i order generic cytotec online

Unless there is a recurrence of bleeding, this group of women with postmenopausal bleeding and a thin EEC generally require no more investigation 64 66 Class 2 how to get cytotec without prescription See The Merck Manual 953 17th ed